Miracle Logistic: Your SMB Import Assistant, Unlocking the Mysteries of Customs and Tariffs in China-US Trade!

As a seasoned enterprise focusing on China-US international freight, Miracle Logistic deeply understands that for many Small and Medium-sized Business (SMB) importers, US customs procedures and tariff calculations can often be daunting challenges. This can not only lead to additional costs but also delay your valuable shipments. However, by understanding these fundamental concepts and having the right partner to assist, complexity can be simplified.

This article, from Miracle Logistic’s professional perspective, will provide you with a practical guide to US customs and tariffs, with a special focus on how we, through close collaboration with our top-tier customs brokerage partner with 30 years of industry experience in the United States, and by offering DDP (Delivered Duty Paid) services, can make your China-US trade smoother and more worry-free.

I. Why Understanding US Customs and Tariffs is Crucial?

U.S. Customs and Border Protection (CBP) is responsible for managing all goods entering the United States. Their primary duties include:

- Ensuring National Security: Preventing illegal items from entering.

- Collecting Duties and Taxes: Contributing to national revenue.

- Maintaining Fair Trade: Ensuring imported goods comply with US standards.

For SMB importers, accurately declaring your goods, understanding applicable tariffs, and complying with CBP regulations are key to avoiding delays, fines, and unnecessary costs.

II. Core Concept Explained: What are Tariffs?

Tariffs (Duty/Tariff) are taxes that must be paid to the US government for goods imported into the United States for sale. They are determined based on the country of origin and the product category (HS Code).

- Product Category (HS Code): The HS (Harmonized System) code is an internationally recognized system for classifying goods. Each product has a unique HS code, which directly determines the tariff rate you need to pay.

- Country of Origin: The place where the goods were manufactured. Trade agreements between different countries can affect the final tariff rate.

- Free Trade Agreements (FTAs): Many countries have signed Free Trade Agreements with the United States, which may mean that eligible goods can enjoy lower or even zero tariffs.

Miracle Logistic’s Value: Our professional team can assist you in accurately identifying your product’s HS code and, based on its country of origin, estimate the most accurate tariff costs, helping you have a clear understanding for pricing and cost accounting.

III. Customs Declaration: Your Import “Pass”

Customs declaration is the formal process of legally bringing your goods into the United States. This requires submitting a series of documents to prove your right to import and that the goods comply with all regulations.

Key documents include (but are not limited to):

- Commercial Invoice: A detailed list of goods in the transaction, quantities, prices, buyer and seller information, etc.

- Packing List: Specifies the contents, weight, and dimensions of each package.

- Bill of Lading / Air Waybill: Contract of carriage and proof of ownership of the goods.

- Certificate of Origin: Certifies the country of origin of the goods.

- Permits or Certificates required by other government agencies: Such as FDA, FCC approval for food, drugs, electronics, etc.

Miracle Logistic’s Support: We understand the importance of document accuracy. We will assist you in preparing and reviewing all necessary documents, ensuring information is error-free, greatly improving customs clearance efficiency, and preventing delays caused by document issues. To ensure ultimate professionalism and efficiency, we work closely with our seasoned customs brokerage partner, who has 30 years of industry experience in the United States, to provide you with the most professional and reliable customs declaration services.

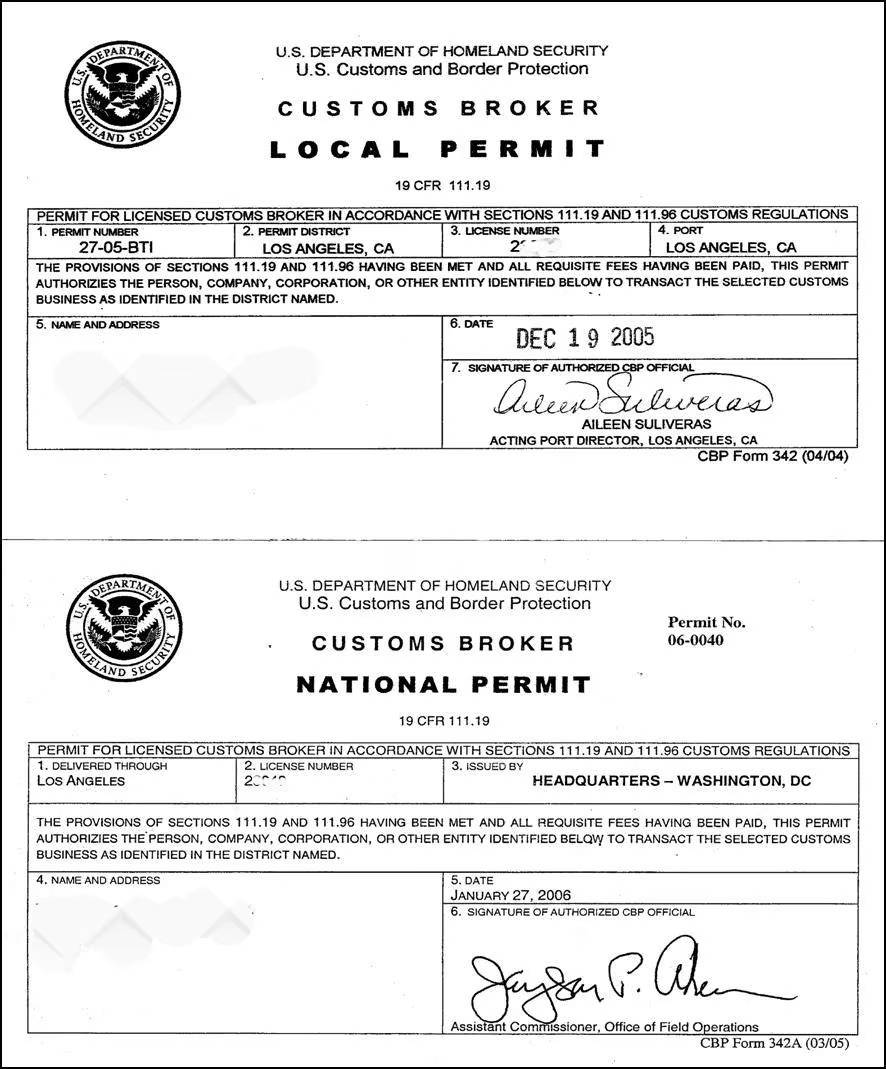

IV. Deep Collaboration: Our Trusted US Customs Broker Partner

To ensure that every shipment can pass through US customs smoothly and efficiently, Miracle Logistic has carefully selected and established long-term, stable cooperative relationships. Our proud partner is:

- 30 Years of US Local Customs Brokerage Experience: Our customs brokerage partner has been deeply involved in the industry in the United States for 30 years, possessing a profound understanding and precise grasp of US customs regulations, procedures, and policy changes.

- Exceptional Professional Team: Equipped with a team of experienced customs clearance experts familiar with the clearance requirements for various types of goods, capable of handling complex and ever-changing customs issues.

- Efficient Clearance Speed: Leveraging extensive experience and good government relations, they can minimize customs clearance times and reduce shipment delays.

- Strict Compliance: Rigorously adheres to all US customs regulations, ensuring your goods are legal and compliant, avoiding potential fines and legal risks.

- Comprehensive Services: In addition to basic declarations, they can provide value-added services such as commodity inspection, tax consulting, and origin certificate review.

By joining forces with this experienced partner, Miracle Logistic can offer you more competitive customs clearance solutions, significantly enhancing your import experience.

V. The Role of “Importer of Record” (IOR)

You may have noticed that the “Importer of Record” is the entity that assumes responsibility for imports to the CBP. For many SMBs, this can present the following situations:

- Having a US Entity: You may have your own US company that can act as the IOR.

- No US Entity: You may wish to avoid establishing a company in the US, or you may want to transfer the legal and financial responsibilities of importing.

Miracle Logistic’s Solution: Miracle Logistic can provide “Importer of Record” services for you. This means that even if you do not have a company established in the US, we can act on your behalf to assume the importer’s responsibilities, handling all necessary customs declarations and paying duties and taxes. Throughout this process, our customs brokerage partner with 30 years of experience will provide professional support to ensure all IOR-related legal and financial responsibilities are properly handled.

VI. DDP (Delivered Duty Paid) Service: Your Worry-Free Import Choice!

For SMB importers seeking ultimate convenience and cost predictability, Miracle Logistic strongly recommends our DDP (Delivered Duty Paid) service. DDP is an Incoterm that means:

Miracle Logistic Assumes All Responsibility: From the moment goods are dispatched from your factory (or designated location) to their final delivery to your customer in the US, we bear all logistics, transportation, insurance, customs clearance, and all related expenses, including all duties and taxes.

You Simply Receive the Goods: You do not need to concern yourself with complex customs procedures, tariff calculations, or subsequent tax matters. Once the goods arrive at the destination, you simply sign for them.

Core Advantages of DDP Service:

- Simplified Process: You are virtually uninvolved in any customs and tax aspects, greatly saving your valuable time and energy.

- Clear Total Cost: Before shipment, Miracle Logistic will provide you with a clear quote that includes all expenses (including duties, taxes, freight, etc.), allowing you to accurately forecast and manage your import costs. This is crucial for SMBs in product pricing and profit calculation.

- Elimination of Unexpected Costs: Under traditional CIF or FOB terms, unforeseen port charges, customs delay fees, etc., may arise. DDP transfers these risks and responsibilities to Miracle Logistic. Our 30 years of experience customs brokerage partner ensures the accurate calculation and payment of all duties and taxes within the DDP service.

- Enhanced Customer Satisfaction: If you are reselling goods to US customers, DDP service means you can deliver goods directly to your customers, offering a perfect “door-to-door” experience, thereby increasing customer satisfaction and loyalty.

- Focus on Your Core Business: No longer distracted by complex international logistics and customs affairs, you can focus more on product development, marketing, and sales.

VII. Miracle Logistic: Your Reliable China-US Trade Partner

For SMB importers, Miracle Logistic is more than just a freight forwarder; we are your trusted business partner. We:

- Provide professional HS code inquiries and tariff estimations: Helping you plan costs in advance.

- Ensure the accuracy and compliance of all customs clearance documents: Reducing customs obstacles. This is thanks to the professional collaboration with our top-tier US customs brokerage partner with 30 years of experience.

- Offer convenient “Importer of Record” services: Simplifying your import process, especially for clients without a US entity.

- Provide leading DDP services: Allowing you to experience unprecedented worry-free imports, achieving cost predictability and extreme process simplification.

- Manage all communication with CBP and other regulatory bodies: Allowing you to focus on your core business.

- Provide optimal shipping solutions and cost control: Ensuring your goods are delivered in the most efficient and economical way.

- Maintain constant information transparency: Keeping you informed of your shipment status at all times.

VIII. Conclusion

While the US customs and tariff system can be complex, with the right knowledge and strong partner support, you can navigate it with ease. Miracle Logistic is committed to clearing obstacles for you, enabling your SMB to confidently enter the US market and achieve every successful import. With our deep cooperation with our US customs brokerage partner of 30 years of experience, and our leading DDP services, we offer you the most superior import solutions on the market, and are the ultimate choice tailor-made for SMBs pursuing efficiency, low risk, and cost transparency.

Choose Miracle Logistic and make your China-US trade journey worry-free from now on!

Contact us now and start your “Miracle” journey!